.png)

Investors seek higher returns without protocol hopping, predictability without sacrificing liquidity, and simplicity without compromising efficiency. Vault tokens transition from concept to practical tool precisely here. This guide provides a clear roadmap: where to deploy them now, how to extract more stable yields, and when to leverage automation and AI. In under twenty minutes, readers will understand what actions to take, the rationale behind them, and the effort required.

The previous article covered core mechanics: deposits, share issuance, strategy composition, and base asset redemption. Now the focus shifts one level higher to where tangible value emerges and critical decisions matter:

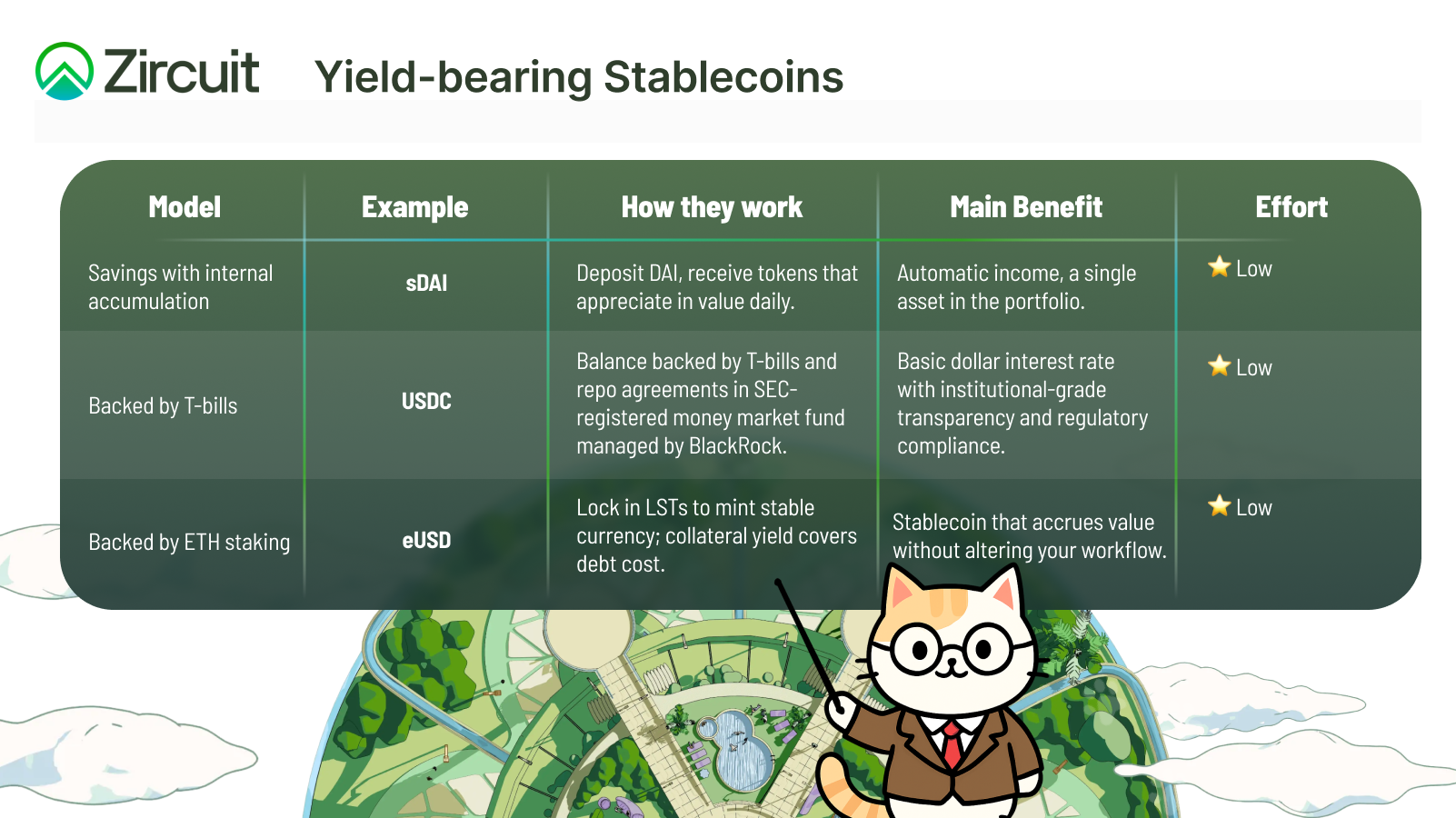

Productive stablecoins function as onchain savings accounts. Holders retain the token while interest accrues automatically. No additional interfaces. No extra transactions. Three model examples to inform your decision:

Typical returns range from 3-8% APY depending on interest rate cycles and yield sources. Recent periods saw rapid deposit growth when savings rates increased. For LST products, ETH staking has consistently delivered 4-5% annually.

Important risks require evaluation. Overcollateralization can constrain scalability, while pegs tend to deviate during market stress. RWA-backed assets demand additional governance and audit layers for safe operation.

Use this practical checklist:

After completing these checks, you'll have a clear, efficient method to generate organic yield on idle capital.

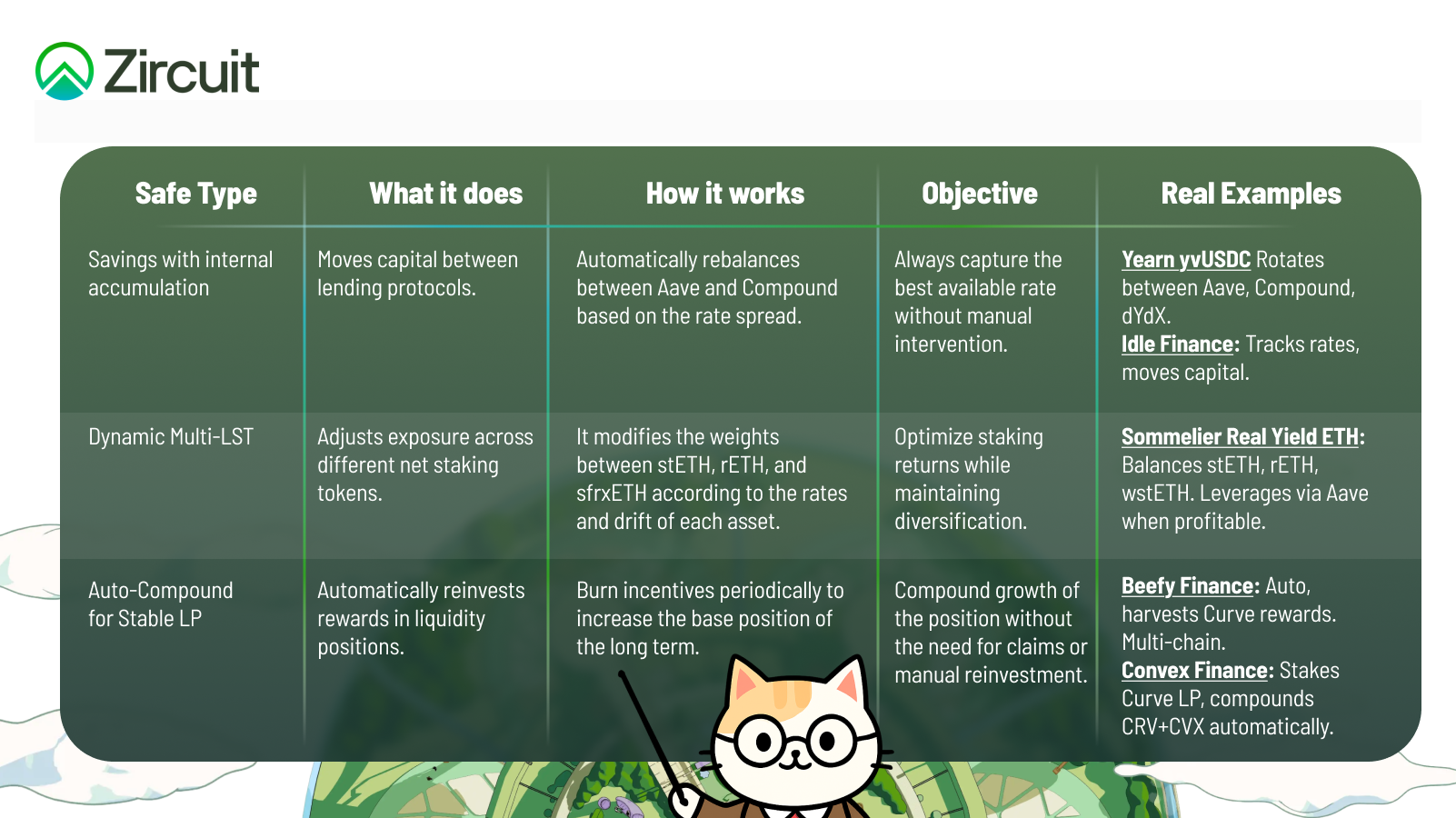

Manual rate chasing wastes time, burns gas fees, and risks entering strategies at capacity. Aggregators solve this through intelligent automation. Yearn, Idle, Sommelier, and Beefy exemplify different approaches but share common logic: monitor market rates, reallocate capital within safety parameters, auto-compound returns, and issue vault tokens that appreciate in value.

When are aggregators worthwhile? The answer is straightforward: when inter-protocol rate spreads fluctuate significantly throughout the week, when strategies require frequent harvesting for efficiency, when the same stablecoin operates across multiple chains with shifting incentive allocations, or when position size is small.

Advantages:

Disadvantages:

Validate the last point by monitoring TVL curves and analyzing marginal return degradation as vault size increases.

Pendle exemplifies yield transformation by creating a tradable market that separates principal from interest into two distinct tokens: PT (Principal Token) and YT (Yield Token). Two clear use cases emerge:

The dual benefit: complete predictability for cash flow planning, or yield leverage when positioning for rate appreciation. The operational complexity is moderate, where you execute the initial split, then hold until the target date.

PoolTogether follows different logic, converting yield into lottery prizes. Users deposit funds, collectively generated interest funds the prize pool, while principal remains fully intact throughout. Users compete for daily or weekly prizes. The behavioral benefit is significant: it creates a compelling savings incentive without capital loss risk. Effort required is minimal, where one deposit generates automatic draw entries.

Why This Matters

These applications exist exclusively because of vault infrastructure. The reason is fundamental: interest must be tokenized or structured as a predictable flow to enable this type of manipulation.

Principal remains untouched while interest becomes a completely independent asset that can be traded, purchased, or distributed as prizes. Without vault tokens, isolating this yield flow with the necessary efficiency and minimal friction would be impossible.

The new generation of DeFi credit uses vaults as core infrastructure. Each protocol addresses a specific challenge in the lending landscape:

Problem Addressed: High spreads between lender and borrower rates

Mechanism: Direct peer-to-peer matching between lenders and borrowers improves rates for both parties simultaneously. When no match exists, positions default to the base pool and operate normally.

Benefit: Several percentage points higher APY while maintaining equivalent structural risk

Additional Feature: MetaMorpho enables users to select credit vaults with predefined, audited risk policies. Capital is distributed across isolated markets according to preset parameters within curated vaults.

Problem Addressed: Lack of segregated margin trading in DeFi

Mechanism: Credit Accounts function as isolated margin accounts. Users deposit collateral, access credit, and execute strategies exclusively through whitelisted protocols, which enables liquidity provision, vault participation, or hedging without exposing their primary wallet.

Benefit: Leveraged yield strategies with segregated, controlled risk

Operational Complexity: Moderate, requires understanding position limits and monitoring account health

Example Implementation: The dWETH pool (0xda00…f26f4f) generates returns from three sources: borrower interest based on a utilization curve, additional APR determined by GEAR staker gauges each epoch, and periodic incentive rewards such as GEAR tokens. Users deposit collateral, borrow to achieve approximately 3× leverage, and maintain positions entirely within the Credit Account. Available strategies include minting stETH through Lido for amplified exposure, composing Curve + Convex positions, or utilizing Ethena integrations for delta-neutral yield. All contract executions are done through approved sources while the funds remain in the Credit Account.

Problem Addressed: Contagion risk across lending markets

Mechanism: Completely isolated markets per asset. Each lending pair operates in an independent silo, preventing catastrophic failures from spreading across the ecosystem.

Benefit: Ability to deposit or borrow long-tail assets with genuine risk isolation

Operational Complexity: Low after initial setup, but requires significant upfront effort in selecting the appropriate silo for the user's risk profile

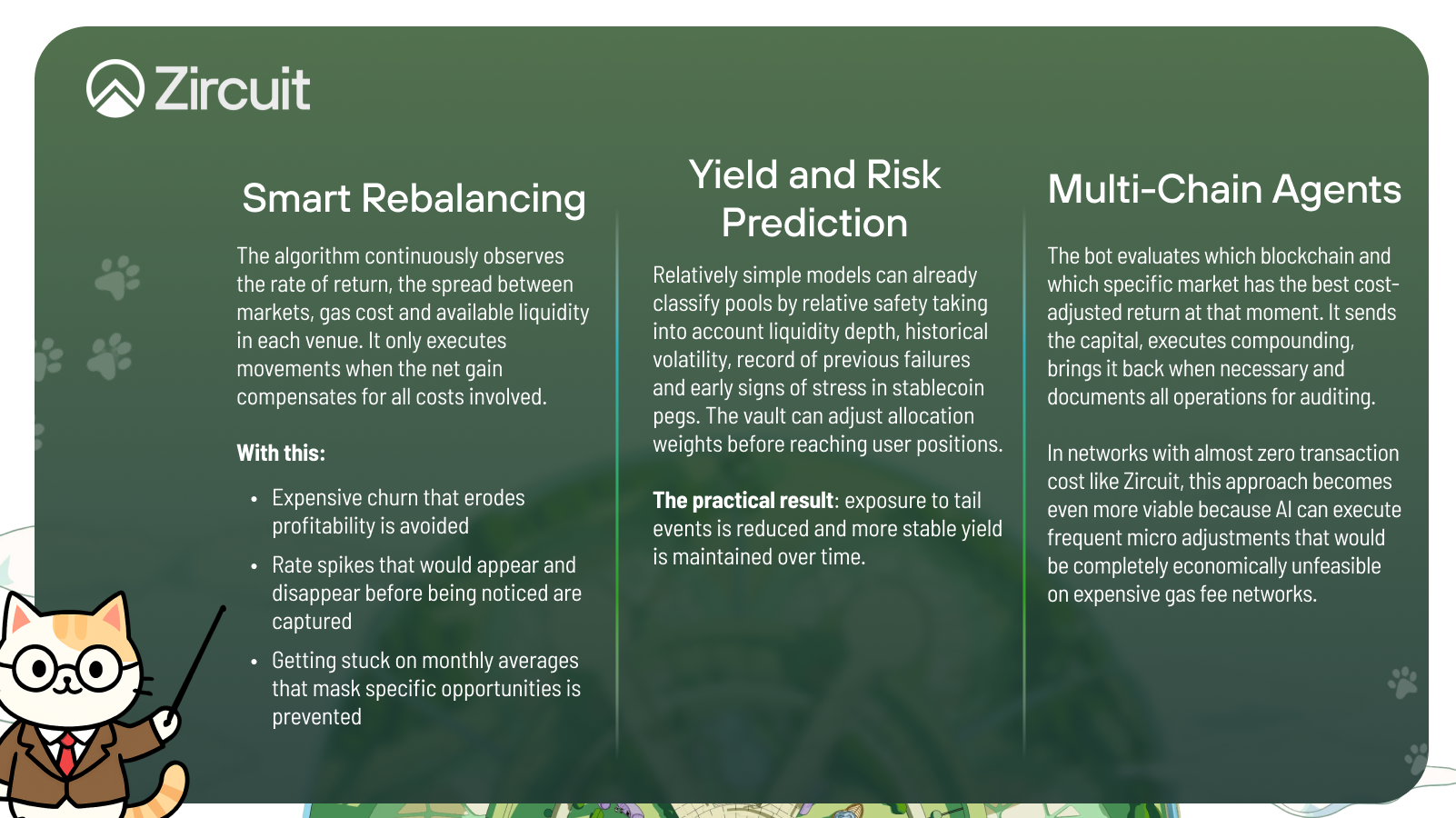

Artificial intelligence assists in determining optimal capital movement timing, transaction sizing, and precise risk positioning. Three clear applications are operational today.

AI-Powered Products Available Now

Sommelier exemplifies AI-driven vault management through automated vaults pursuing maximum returns via dynamic strategies. The ETH vault combines Aave and Compound leveraged staking with Uniswap V3 liquidity positions, concentrating exclusively on stETH strategies. All vault actions remain visible onchain, ensuring complete transparency. The protocol operates across multiple chains by transmitting rebalance instructions to vault smart contracts without asset bridging. Only the execution commands cross chains while capital stays secured in its original location.

Enzyme provides vault frameworks with automated LP strategy execution. The system incorporates a vault management api and allowlists of audited protocols. Users access over 350 digital assets with automated back-office processes through smart contracts. Integrations span Yearn, Idle, Aave, Compound, and dozens of additional DeFi protocols. Vault managers extract real-time and historical data through the Enzyme API to build automated trading systems executing based on predefined parameters.

Still there are objective warnings to consider: AI doesn't replace human auditing of code and processes. AI can overfit strategies to historical market regimes that won't recur. Poorly configured AI can consume more in gas fees than it generates in gains without clear operational limits.

Essential Safeguards:

Now that you've explored various protocols and examples, it's time to organize ideas into action. Follow this step-by-step approach to structure your strategy:

Begin by identifying where the yield originates, as this directly shapes realistic expectations. Lending interest generates relatively stable returns. Staking rewards offer predictability within network parameters. Incentive-driven yields, however, should be treated as temporary. Document the source for each position.

Examine the protocol's infrastructure through critical questions: Which oracle feeds the system? What liquidation parameters are in effect? What audits are available? Who controls upgrade keys? Beyond documentation, verify production track record, active bug bounty programs, and historical incident reports that may reveal vulnerabilities or response patterns.

Evaluate exit feasibility through practical testing. Access the primary trading pair, examine order book depth, and simulate a 10% position exit to measure slippage. Understand the redemption mechanism—whether through DEX swaps or direct contract withdrawals. If withdrawal queues exist, note expected timeframes to avoid surprises during market volatility.

Assess the vault token's versatility across the ecosystem. Determine where it functions as collateral, whether it trades on Pendle for yield speculation, and if major AMMs offer stable liquidity pools. Greater ecosystem connectivity enhances utility and resilience. However, concentration risk remains real, where you maintain diversification across different DeFi infrastructure layers.

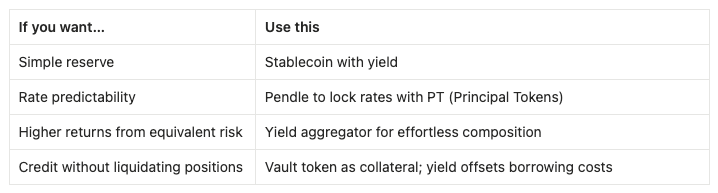

The table below maps specific implementation paths to different goals:

Use leverage only when all of the following conditions are met:

Lastly, it is very important to have a due diligence plan in case of need. It will assist in situations of extreme urgency, indicating what to do. For this, keep these questions in mind:

After reviewing all the information above, the path forward should be clear:

Step 1: Define your strategy - Choose a single use case: short-term cash, stable yield reserve, or collateral for credit. Articulate the objective in one clear sentence.

Step 2: Select the appropriate product - Match a product to your objective: sDAI for straightforward savings, Pendle PT for fixed rates, PoolTogether to gamify reserves, a yield aggregator for automated compounding, or a curated credit vault for risk-aligned lending.

Step 3: Establish risk parameters - Define acceptable limits for both time and capital, configure peg and APY alerts.

Step 4: Document your entry - On first deposit, record the date, observed APY, and planned exit route.

Step 5: Review and iterate - Revisit the position after seven days. Compare planned versus actual performance, adjust parameters as needed, extract lessons from the experience, and repeat the cycle.

Vaults have evolved beyond passive savings vehicles into fundamental infrastructure. They power yield-bearing stablecoins, enable tradable interest rate markets on Pendle, gamify savings through PoolTogether, and enhance credit via Morpho, Silo, Ajna, and Gearbox.

The next evolution is already underway: automation and artificial intelligence determining optimal timing, allocation sizing, and exit points. This advancement delivers three key benefits: higher yield per unit of effort, greater predictability with reduced stress, and expanded opportunities to deploy the same capital across multiple DeFi layers. All of this is accessible today, with clear implementation paths and minimal complexity.

Comprehensive protocol mastery isn't a prerequisite. This framework functions precisely because it separates strategy from execution: you define the objective, the appropriate product handles the operations. Start small, test with a single use case, evaluate results after seven days, and refine your approach. The most effective way to learn productive DeFi is through practical experience with real capital, regardless of amount. Understanding develops through action, not accumulated theory alone.

Want to dive deeper? Explore the Zircuit documentation, join our Grants Program with vault ideas, or connect with the team to discuss integrations and use cases.

Until next time,

The Zircuit Team 💚